U.S. Infrastructure

*Excluding defense. Source: Haver Analytics & Financial Times

In the United States, a pressing need exists to rebuild deteriorating roads, bridges, water systems and other public infrastructure. However, public agencies often lack the funds to procure design and construction services for all of their infrastructure needs. Over the past several decades, public investment in infrastructure has dropped and there is no indication this will change. The American Society of Civil Engineers (ASCE) has estimated that between now and the year 2020, there is a U.S. “funding gap” for infrastructure of $1.1 trillion. Thus, there are strong structural forces that are driving state and municipal project sponsors to consider alternative financing arrangements for infrastructure.

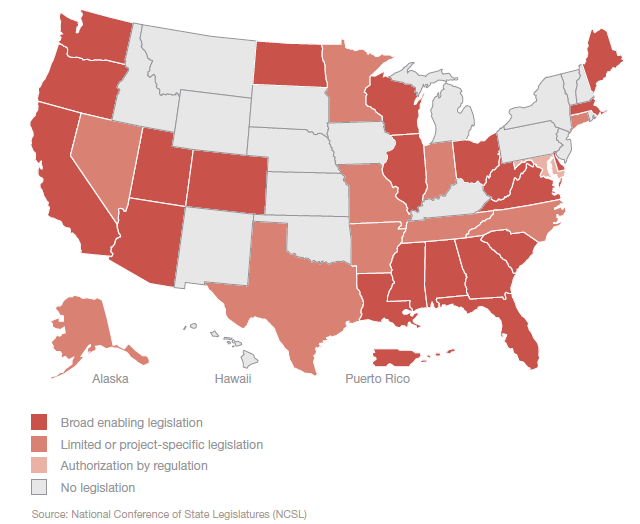

To enable alternative financing for infrastructure project, more than two-thirds of U.S. states have enacted Public-Private Partnership-enabling statutes. Public agencies and leaders in these states view public-private partnerships as a unique means of improving public infrastructure without relying on public money.

States with P3 Enabling Legislation

Participation of private institutional investors in infrastructure projects has historically been more limited in the U.S than in other markets, such as the UK, Canada, and Australia. As institutional investor participation increases here in the United States, their involvement should provide value to the public sector, either through direct cost savings, time savings, risk avoidance or a combination thereof.

MWH Infrastructure Development Inc. has cultivated relationships with dozens of institutional infrastructure investors. Typically, our investor partners represent pension funds, insurance companies and other institutional investors, as the investment timeframe and goals of those investors are well aligned with public sector project sponsors. Pension funds, for example, seek long-term, lower risk investments with reliable returns to provide cash flow to meet payout obligations.

MWH Infrastructure Development Inc. understands that effective P3s are founded on a team-based relationship in which public and private parties contribute their combined knowledge, expertise and skills to a project. Selecting the right team and bringing clarity to each party’s goals and requirements is critical to achieve the extraordinary amount of cooperation and coordination required among the parties.

In addition to having a strong network of institutional investor partners, MWH IDI is also well-connected with public-sector project sponsors and delivery partners. MWH Global has over sixty offices across the U.S.. Our reputation, footprint, and hundred-year history, coupled with our deep technical, financial, regulatory, and program management experience, have resulted in an extensive and valuable network of consulting, engineering, construction, operating, and financing partners. MWH IDI leverages market knowledge and carefully considers project requirements when choosing both the institutional investor partner and the engineering-procurement-construction (EPC) and operating partners.

MWH Global North America Offices

Meet our Team

Meet the Infrastructure Development Inc. team

The P3 Project Structure

Learn about the P3 Development Process

Infrastructure

Read more about Alternative Financing for Infrastructure

Risk Transfer

Learn about Risk Transfer and Risk Shifting