By: Robyn McGuckin; principal management consultant and Dennis Pungitore; renewable energy consultant

This post discusses some of the challenges specific to the project development phase of small renewable energy projects, and the mechanisms available to overcome these challenges. Project development is where most projects fail due to the complexity of bringing together the many complex factors required to ensure the longer term financial and technical success of the venture. Renewable energy projects provide multiple benefits including:

Energy security: Distributed sources of energy can provide greater stability of the grid and alternatives sources of power when black-outs or brown-outs occur.

Access for off-grid areas: In the developing world there are many communities where large, centralized power simply will not reach in the foreseeable future. Small renewable energy projects are one of the few viable alternatives.

Lower impact: Renewable energy projects have a lower social and environmental impact than either the equivalent sized conventional energy sources, or large centralized energy.

Life-cycle costs: Increasingly, renewable energy projects are coming closer to ‘grid-parity’ – meaning they cost nearly the same as conventional energy. This is more the case when considering the life cycle costs and externalities as compared to conventional energy sources, and also more true for larger projects where economies of scale factor in.

Life Cycle of Small Renewable Energy Projects

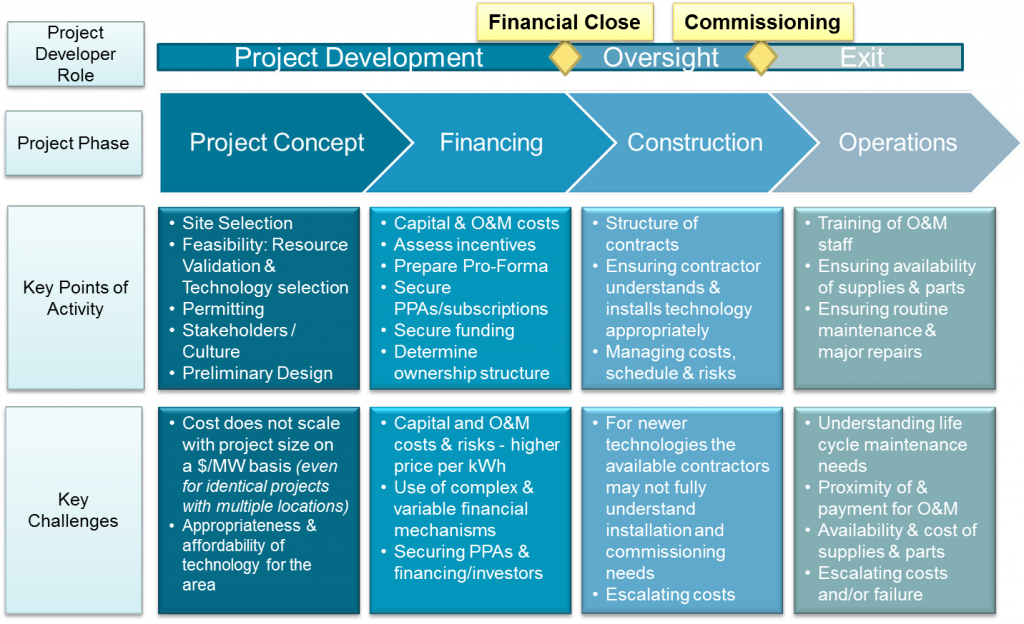

The planning and preparation of small renewable energy projects spans several phases of a typical life cycle. Broadly speaking, the general project life cycle is depicted in the flow chart presented in Figure 1.

Figure 1: Life Cycle of a Renewable Energy Project

Challenges of Project Development for Small Renewable Energy

The challenge of the project development phase is that the same issues need to be resolved whether the project is 500 kW or 500 MW. The particular financial burden of small renewable development is that the cost of crucial activities, such as legal, financing and permitting, does not shrink with project size. Economy of scale has always favored larger projects since the fixed costs are spread over higher energy output-based revenues. A great deal of time and effort must go into a project from the concept through funding. Typically a lender will require that all definitive contracts, permits and agreements are in place prior to funding a project. Obtaining this level of detail requires a great deal of equity, knowledge and effort. This is a classic chicken and egg issue. Funds are required to advance the project, but the project must contain enough detail to allow for financing. A great many projects stall or fail at this stage of development.

Mechanisms Available to Incentivize Renewable Energy Projects

There are many financial mechanisms in place to incentivize renewable energy projects around the world. In addition to helping projects overcome inherent financial hurdles, there are two key attributes of good financial mechanisms:

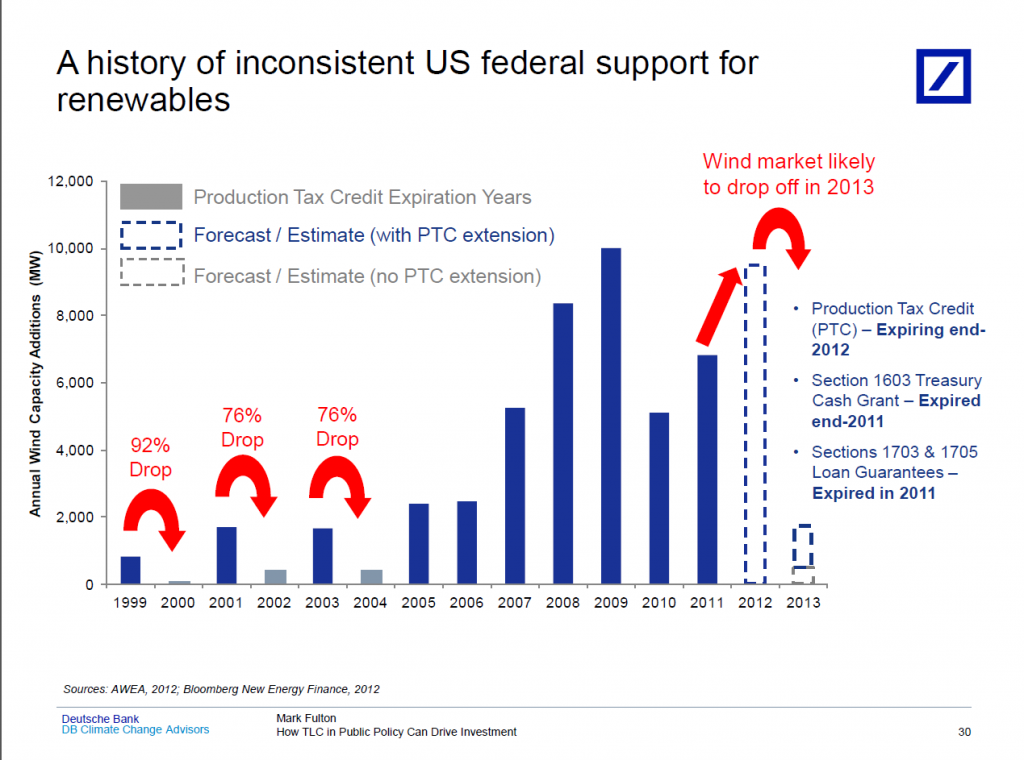

The first critical element of government-sponsored incentives schemes is that of surety. Investors and project developers must feel confident that the government incentives, once allocated, will not be arbitrarily revoked. The U.S. tax credits for renewable energy, for example, are subject to legislative renewal every two or five years. Additionally, how and when the incentives are disbursed can distort the already complicated development process. As a result, there is often a rush to start or complete the project that is related to the availability of the incentives, as opposed to managing the project for the most efficient use of capital in the development process. The chart shown in Figure 2 demonstrates the impact of that lack of surety in U.S. wind tax incentives has had on wind capacity additions. The dramatic swings shown in Figure 2 exemplify the need for surety and the impact that the lack of surety has on markets.

Figure 2: Impacts on the Wind Market of the Short Cycle for Wind Tax Incentives in the U.S. (Source: Mark Fulton, “How TLC in Public Policy Can Drive Investment,” Deutchse Bank Climate Change Drive Investment)

A second key issue is that of consistency of incentives across multiple regions within a country. In the U.S., each state has its own regulatory incentives and standards, which is further complicated by the incentives available from individual power utilities within a state, such as green power tariffs. This makes it extremely difficult for companies to do business across multiple states and increases their costs to do so. In fact, many of these companies hire dedicate staff specializing in key states to fully understand the financial implications, local requirements and incentives for renewable energy, making both the initial project development and the replication of successful projects in new areas quite challenging.

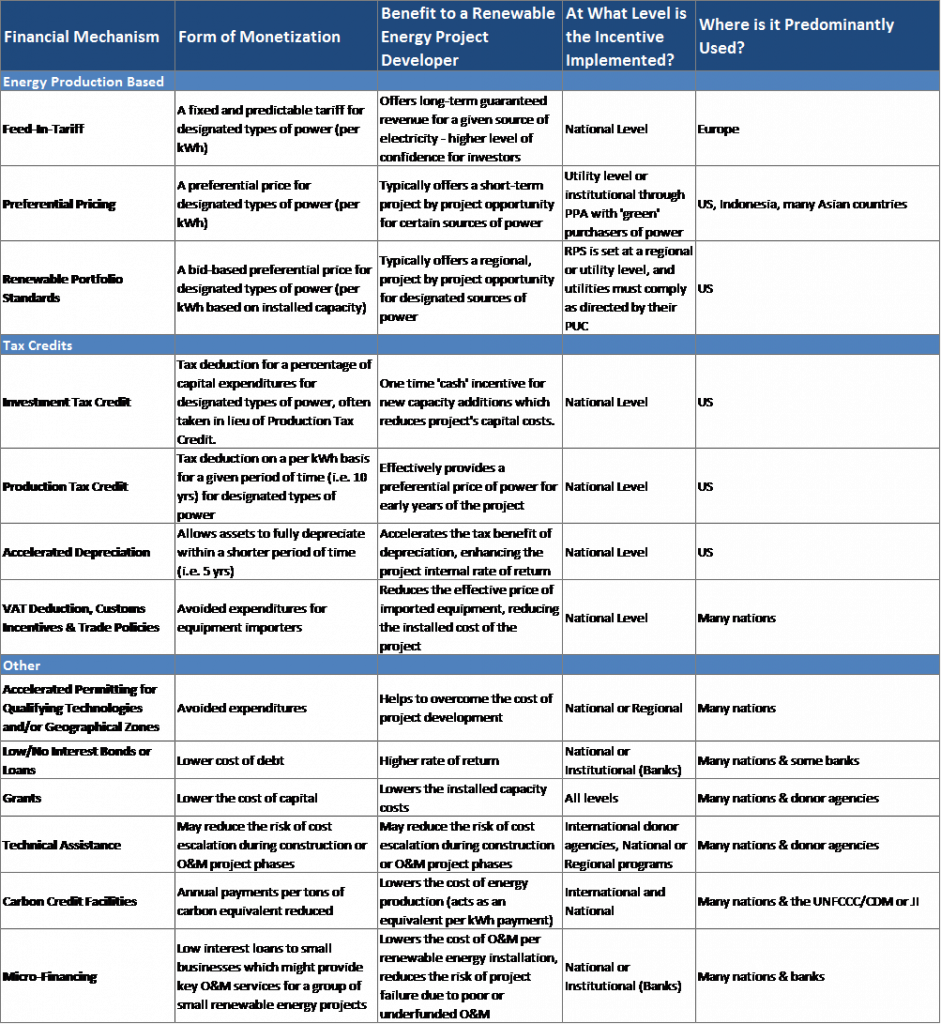

Figure 3 below shows a number of the different types of incentives available to overcome the financial and regulatory hurdles for renewable energy projects.

Figure 3: Examples of Internationally Available Incentive Mechanisms for Renewable Energy Projects

Conclusion

Project development and financing are the most critical steps in the project life cycle for the success of small renewable energy projects. These steps can be extremely challenging for small renewable energy projects because the fixed costs of project development are typically the same for small projects as they are large projects. As result, the relative percentage of the up-front investment required for small renewable projects is quite high.

In order to overcome the difficulty of project development and financial planning, proper incentives for renewable energy are extremely important.

In the final analysis, each step in the project concept and development phase and in the project finance phase sets the framework and the baseline for the ultimate long-term success of the project. Ensuring that the proper analysis and steps are taken throughout these two phases is critical to ensuring the greater success of individual projects. Similarly, ensuring that incentive schemes are properly designed to optimally reduce the barriers inherent in developing a financing small renewable energy projects is essential to meeting goals of greater saturation of successful projects.